Debt can be a significant financial burden, but with strategic planning and informed decision-making, individuals can manage, repay, and avoid debt effectively. This discussion delves into proven debt repayment strategies, including the snowball and avalanche methods. It also explores the impact of various types of debt, such as credit card debt and student loans, and provides valuable tips for avoiding debt traps and making informed borrowing decisions.

Effective Debt Repayment Strategies

1. Snowball Method:

- Approach: List debts from smallest to largest regardless of interest rates.

- Rationale: Focus on paying off the smallest debt first, gaining momentum and motivation, and then applying those payments to larger debts.

2. Avalanche Method:

- Approach: Prioritize debts with the highest interest rates, paying off high-interest debts first.

- Rationale: Saves money in the long run by minimizing interest payments, even if the smallest debts are not tackled first.

3. Consolidation Loans:

- Approach: Combine multiple debts into a single loan with a lower interest rate.

- Rationale: Simplifies repayment by managing one loan instead of multiple debts, potentially reducing monthly payments.

4. Negotiating Interest Rates:

- Approach: Contact creditors to negotiate lower interest rates.

- Rationale: Lower interest rates mean more of each payment goes toward reducing the principal balance, expediting the debt repayment process.

Impact of Different Types of Debt

1. Credit Card Debt:

- Impact: High-interest rates can lead to significant long-term costs.

- Advice: Paying more than the minimum payment and focusing on high-interest cards first can mitigate the impact.

2. Student Loans:

- Impact: Varying interest rates and repayment plans.

- Advice: Explore income-driven repayment options and consider refinancing for potential interest rate reduction.

3. Mortgages:

- Impact: Long-term debt with substantial interest costs.

- Advice: Making extra payments or refinancing can reduce overall interest payments.

4. Auto Loans:

- Impact: Monthly payments and interest rates vary based on the loan term.

- Advice: Opt for shorter loan terms to reduce interest costs, and consider paying more than the minimum when possible.

Tips for Avoiding Debt Traps and Informed Borrowing

1. Emergency Fund Creation:

- Advice: Establish an emergency fund to cover unexpected expenses, reducing the reliance on credit for emergencies.

2. Budgeting and Expense Tracking:

- Advice: Create and stick to a budget to ensure spending aligns with income, and track expenses to identify areas for potential savings.

3. Educate Yourself on Financial Literacy:

- Advice: Understanding financial terms, interest rates, and debt management strategies empowers individuals to make informed borrowing decisions.

4. Avoiding Impulse Purchases:

- Advice: Pause before making non-essential purchases, giving time to evaluate whether the expense aligns with financial goals.

5. Prioritize High-Interest Debt:

- Advice: Prioritize paying off high-interest debts first to minimize overall interest costs.

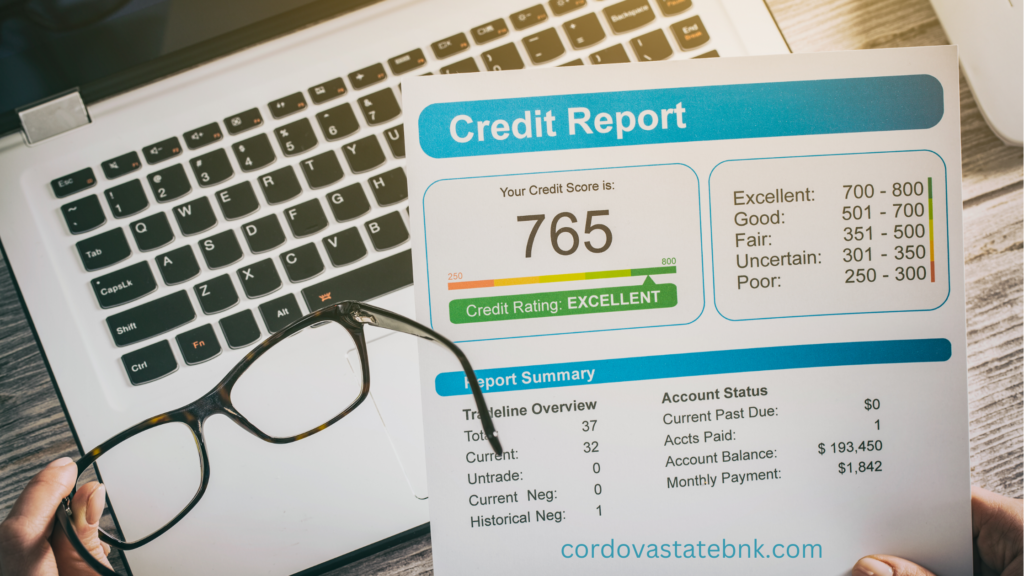

6. Regularly Review Credit Reports:

- Advice: Monitor credit reports for inaccuracies and address any issues promptly to maintain a healthy credit profile.

7. Seek Professional Advice if Needed:

- Advice: Consult with financial advisors or credit counselors for personalized guidance and support in managing and repaying debt.

In Conclusion

Effective debt management involves a combination of strategic repayment approaches, understanding the impact of different types of debt, and adopting prudent financial habits. By utilizing methods like the snowball or avalanche, being aware of the nuances of credit card debt, student loans, and other financial obligations, and implementing tips for informed borrowing decisions, individuals can pave the way to financial freedom and avoid the pitfalls of debt traps. Ultimately, informed financial choices and disciplined debt repayment strategies contribute to building a more secure and resilient financial future.

Leave A Comment